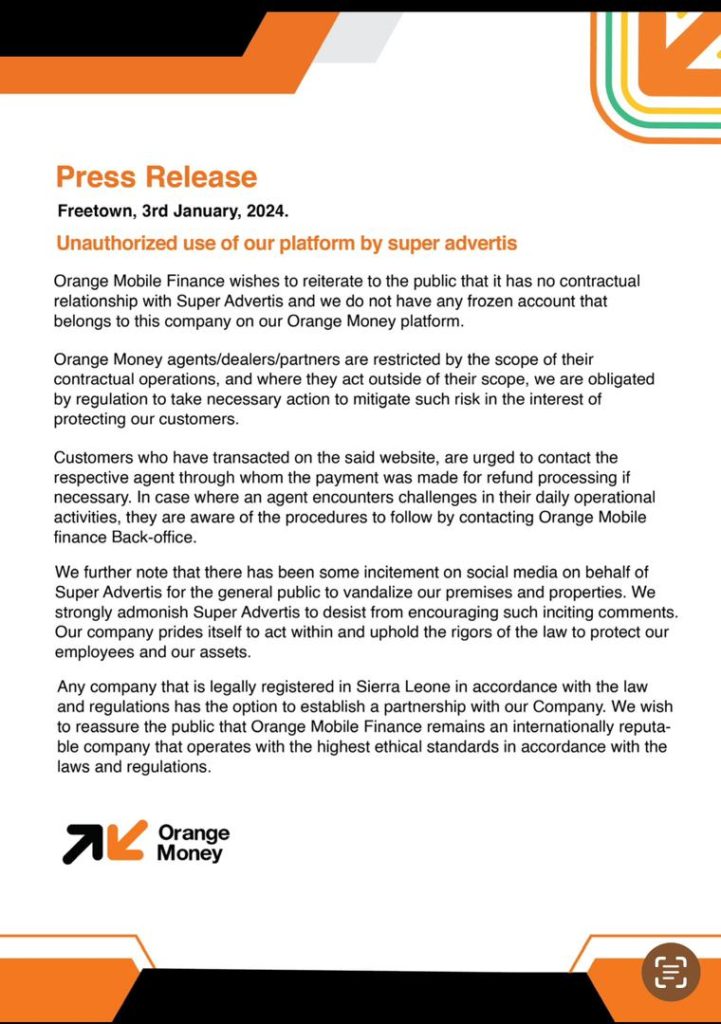

In recent times, the Management Orange Mobile Money Finance SL Ltd issued a Disclaimer disassociating itself from Super Advertis an online business platform . According to the disclaimer, Orange Mobile Money Finance revealed that they are not in partnership with Super Advertis nor have any contractual dealings or in any way associated with the business/company.

The said disclaimer has left many Sierra Leoneans in shocked at home as it came like a lump in the throats of many who have invested their money on the Online Platform realizing that they have been defrauded by Super Advertis. The online business platform was reported to have defrauded Sierra Leoneans of a staggering 9 billion Leones.

Meanwhile, recent public notices by the Bank of Sierra Leone and the Financial Intelligence have vindicated Orange ‘s decision to disassociate itself from Super Advertis .

The Bank of Sierra Leone (BSL) issued a strong warning on the 5th January against the online entity called “SUPER ADVERTIS” that is illegally soliciting investments through mobile money platforms.

The BSL further emphasized that it has not licensed SUPER ADVERTIS for any financial activity, and engaging with them for investments poses a real risk to the public’s finances.

According to the BSL’s public notice, SUPER ADVERTIS appears to be enticing individuals to invest in a secretive financial scheme using mobile money platforms, which involves accepting deposits from the public. However, the BSL clarifies that “SUPER ADVERTIS” operates without the necessary license, making their operations illegal and potentially fraudulent.

The Financial Intelligence Unit (FIU), an institution dedicated to combating financial crime, also initiated an investigation, in collaboration with key stakeholders, into the suspected unlawful activities of Super Advertis.

This entity has been using various mobile money platforms in Sierra Leone to accumulate deposits from the public, falsely presenting itself as an investment opportunity. Super Advertis stands accused of engaging in unlicensed and unregulated financial services, particularly utilizing mobile money agents to amass supposed investment funds.

This alleged scam, resembling a “PONZI SCHEME,” operates by reimbursing existing investors from contributions made by new investors, rather than generating legitimate profits from a lawful business. Investors are misled into believing that profits stem from genuine business operations, while they actually originate from new investors’ deposits.

In a statement made available to Sierraloaded, Orange revealed the deceptive tactics employed by Super Advertis scammers. The company clarified that unauthorized agents were illicitly collecting funds on behalf of the fraudulent platform. Immediate action was taken upon discovering these deceitful transactions, with Orange Sierra Leone promptly blocking the accounts of these unauthorized agents.

The mobile company emphasized that these agents lacked the authorization to engage in such financial transactions, and their accounts were suspended to prevent further fraudulent activities.

“They were using our agents to collect funds on their behalf. These agents are not authorized to perform these types of transactions. When we got alert of these fraudulent transactions, we immediately blocked the accounts of these agents.” the mobile network company said.

Orange Sierra Leone took a proactive approach by reporting the issue to the Bank of Sierra Leone (BSL) and is now awaiting the next steps in the investigation.

According to Orange Sierra Leone, the blocked accounts do not show any clear indication that the embezzled funds are directly related to Super Advertis transactions. The company clarified that the primary reason for blocking the accounts was to curtail the involvement of the suspended agents. Interestingly, all attempts to reach these agents have been unsuccessful, adding another layer of mystery to the unfolding situation.

As consumers dash through investing their money online, fraudsters remain focused. Through its strong compliance measures, Orange was able to detect early signs of an uptick in fraud attempts on Sierra Leoneans.

Realizing the devastating impact of fraud as a trusted Partner, Orange gives everyone the keys to a responsible digital World. Trust is at the heart of Orange purpose and the company’s ethics and compliance approach contributes to this trust by promoting a culture of integrity with no room for corruption of any kind, which cannot be accepted.

Orange fraud and anti-corruption policy is proactive as the company is committed to conducting their business with transparency and integrity in Sierra Leone. Orange stringent anti-corruption policy applies to all employees, managers, and directors, as well as anyone who acts on their behalf.